Geopolitical tensions around resources have been increasing this year, particularly in Europe.

Russia has embarked on an invasion of the Ukraine, and this was met with sanctions by western European governments, particularly on the importation of natural gas from Russia. Currently in Europe natural gas is abundant under the ground but is prevented from being extracted due to not only policy, but also policy rhetoric. The message to industry is that generating power with natural gas over the next decade is going to be discouraged. Under these conditions there are few entities that would invest in natural gas extraction, leading to Russia’s virtual monopoly on natural gas in the area.

So far, the effect of these sanctions has been a sharp uptick in the price of natural gas in Europe, as well as the price of wholesale electricity. Data on these prices is proprietary but the IMF has recently published a working paper that summarises some key figures. Figure 3 from the working paper is reproduced below.

Natural gas is used predominantly to generate electricity for use in manufacturing in Europe. On the left graph, the IMF data shows that the price of gas in Europe (the red dashed line) has increased from near 20 Euros MWh to around 90 Euros MWh in a year. In the right graph, the IMF provides data on wholesale electricity prices in Europe during the same period. This data is categorised by how gas dependent the source is; for the high gas dependent sources (the solid blue line) the wholesale electricity price almost exactly follows the natural gas price.

China is often thought of as the manufacturing centre of the world, but Europe produces large quantities of high-quality processed metals. In an average year, European production comprises 15 percent of global zinc production and 11 percent of steel production.

In late 2021, it was already apparent that energy prices were causing spikes in the price of steel, and this trend is continuing. More recently we’re seeing the effect of energy shortages on zinc production with the prices of zinc futures rising quickly. These processed metals prices have begun to affect prices of highly technical manufactured goods, such as valves and other precision equipment. This will have global implications on the production of many other goods. Even in New Zealand, some of the components that go in to building infrastructure are manufactured in Europe using zinc and steel. The price inflation in everything we’ve seen so far is likely to continue.

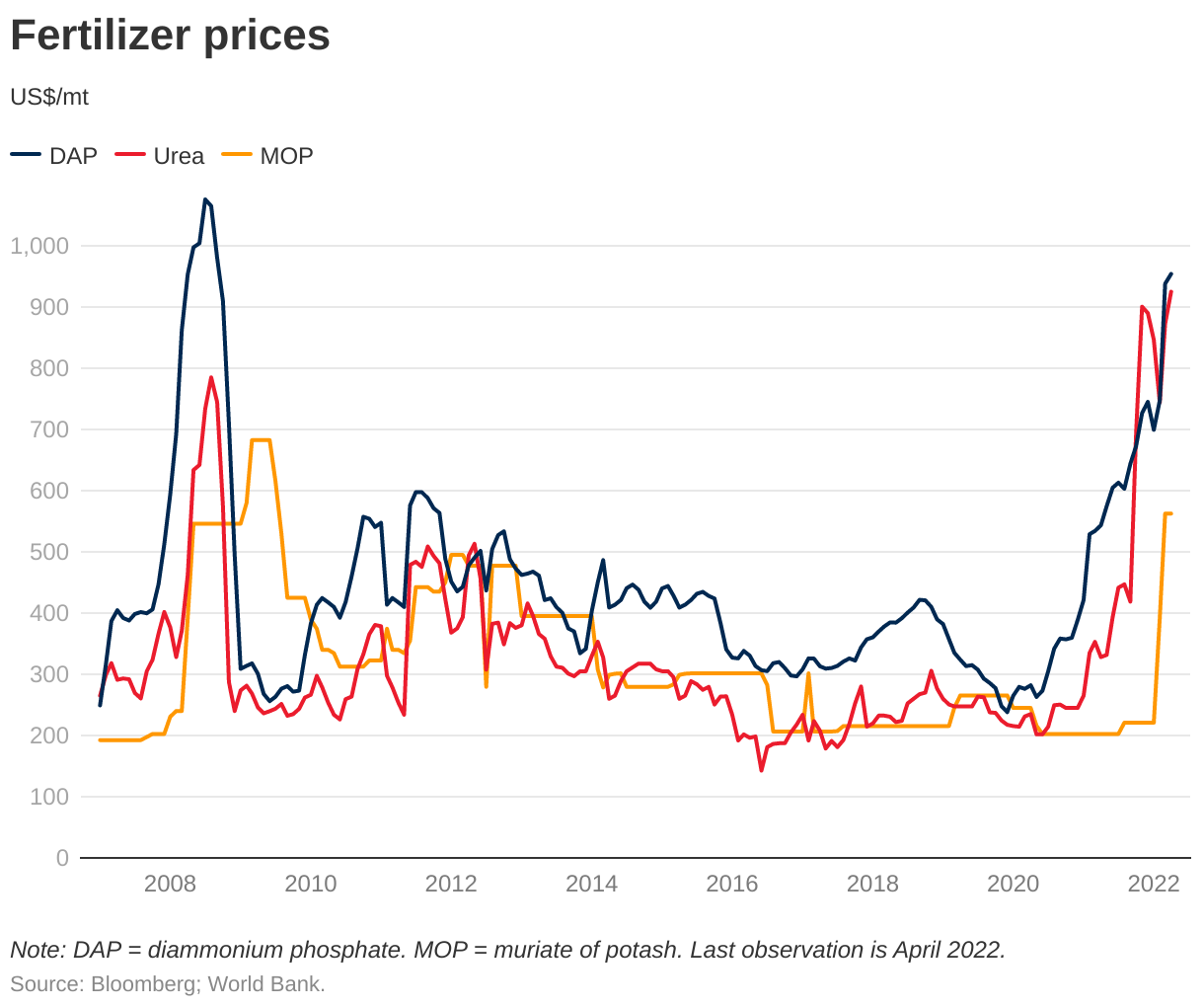

Additionally, food prices have been rising rapidly as the energy price spike is affecting goods such as fertiliser for food production. Data from the World Bank shows the effect energy prices are having on fertiliser in Europe. For just over a decade, farmers could source different fertilisers at roughly stable prices, until late 2021/early 2022 when prices suddenly spiked upwards. This is troubling because modern arable farming relies on fertiliser. Data from Fertilizer Europe shows that wheat and coarse grains use 51 percent of all fertilisers used in Europe. What happens to prices of these grains for the coming harvests seems obvious at this point.