Budget 2025 keeps the show on the road

“The Growth Budget” keeps the government on track towards its fiscal responsibility objectives. Whether it alters the trajectory of the economy remains to be seen.

The Minister of Finance’s impossible triangle

The lens through which to understand Budget 2025 is the impossible triangle Minister of Finance Nicola Willis finds herself in.

This impossible triangle is a tight fiscal outlook driven by budget surplus and debt reduction objectives, a growth and productivity agenda, both stagnant and only recently recovering, and a disrupted and uncertain global economy because of the Trump administration’s trade and tariff policy.

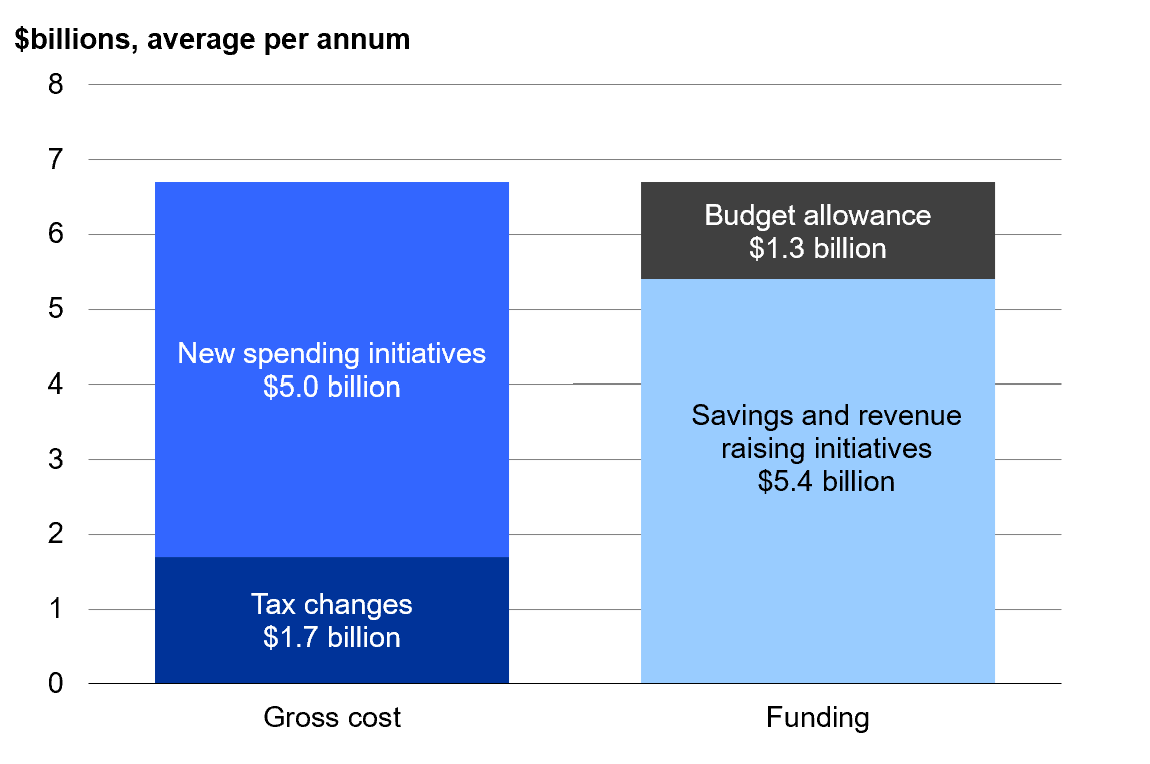

The first implication is a meagre operating allowance of $1.3 billion, the lowest in a decade. Instead, Budget 2025 ($6.7b) is funded through the reprioritisation of existing spending ($5.4b), notably the majority from the controversial reform to the pay equity process.

Budget 2025 at a glance

Supply-side and growth-agnostic

Illustrating the flavour of the “Growth Budget”, the key economic growth initiative, the “Investment Boost” is a supply-side and growth-agnostic measure.

Our first observation is the lead time for Budget 2025 to translate into ‘hard’ economic growth, and not just from its tax policies. The government continues to rely on interest rate reductions from the Reserve Bank to provide a short-term boost to the economy while it takes on the role of developing productive capacity over the medium term. This is commendable and a welcome clarification of the respective roles of fiscal and monetary policy for the economy.

Still, we question how supply-side heavy Budget 2025 is in the face of global economic headwinds. The risk for the government is its overreliance on lowering the cost of capital to spur growth through tax policy changes and expected interest rate cuts.

A recovery is best sustained when the demand and supply sides work in tandem, with business and consumer confidence sustaining demand. As the main demand-side measure, the net capital allowance towards infrastructure spending is set at $4 billion, but regulatory and consenting delays make a timely impact challenging.

Our second observation is the rather agnostic nature of the Budget and key measures. Minister Willis has been consistent in not wanting to pick winners (subsidies to the film sector aside). Value for money is not necessarily achieved through targeted tax measures; still, flagship tax policies and reforms under Budget 2025 are broad in coverage. Investment Boost is arguably targeted insofar as it incentivises investment into productive capital (compared to cuts to the corporate tax rate, for example).

Judging value for money

The obvious question to assess Budget 2025 is whether such a large proportion drawn from reprioritisation achieves greater value for money on net. While difficult to assess exactly, we note the following observations based on the Minister’s policy and Treasury’s documents and forecasts.

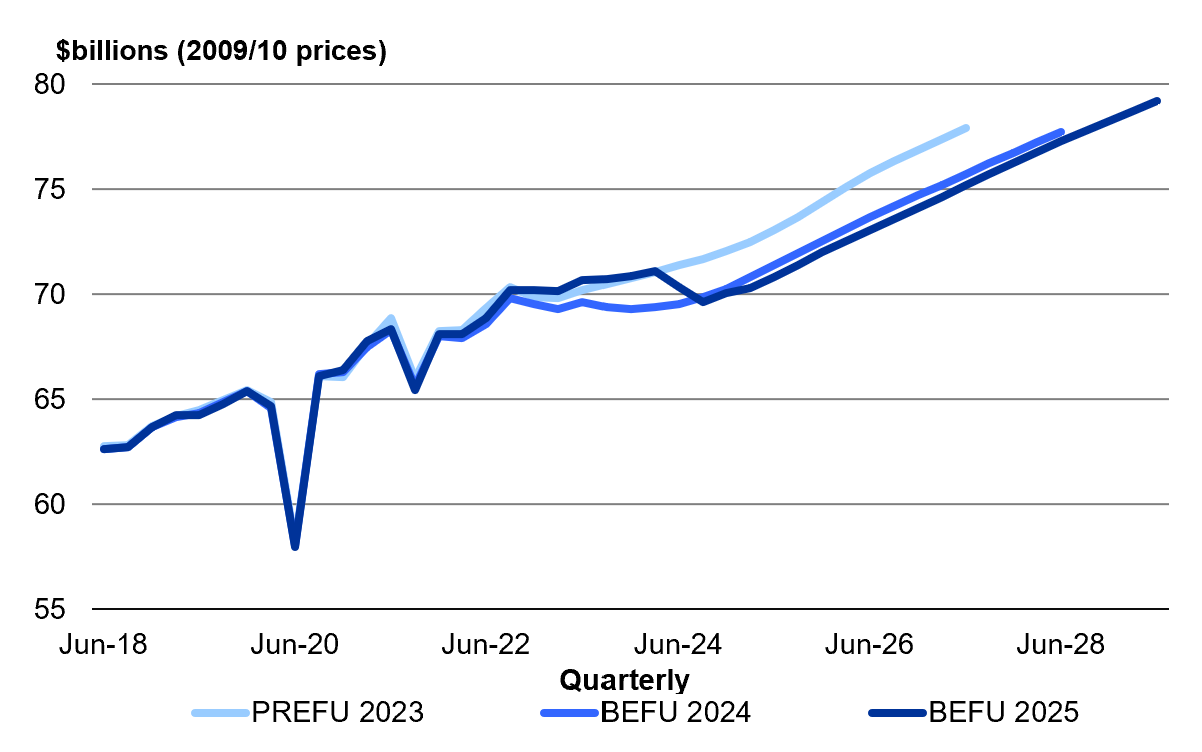

Considering the likely returns from Budget 2025 at face value, we note that GDP, budget surplus, and debt forecast trajectories are marginally affected.

The struggling Growth Budget forecasts

Treasury’s forecasts assume no change in its productivity forecast, the stated purpose of the flagship Investment Boost measure. A generous interpretation is that Budget 2025 effectively makes up for a slowing in the global economy, thereby keeping the government on track towards its fiscal responsibility goals, without improving or bringing them forward.

KiwiSaver reforms shift responsibilities

The other key Budget measure is the reform to KiwiSaver. The evident takeaway from this reform is that the responsibility of retirement savings is gradually being shifted to households and businesses to manage the risks superannuation poses to government debt. The immediate consequence is that businesses, particularly SMEs, will need to consider how to incorporate those costs, but the government’s reform of KiwiSaver is altogether gradual.

Piecemeal social policy

Our final initial observation is that while economic policy is presented with a guiding thread and narrative (even if still unproven as outlined above), the social policy components of Budget 2025 are piecemeal. The exception perhaps being social investment; however, the Social Investment Fund makes up a relatively small portion of the Budget.

The only visible thread tying Budget 2025 social measures is the introduction of means-testing, but the government is not openly acknowledging it as a governing policy principle of theirs (yet). Changes to Working for Families help with the cost of living, alongside other social policy measures, but lack a governing strategy. In the meantime, a broader debate on universalism is likely in the works.

Keeping the show on the road

We are cautiously optimistic that the government is taking a medium-term approach to growth and productivity. That said, the value-for-money of the combined set of initiatives is not yet self-evident, other than making up for the loss in global economic momentum from the US administration’s trade policies. What can be said is that Budget 2025 is keeping the government on track and the show on the road.

The stated high-level narrative for this Budget, seen through the impossibility triangle the Minister of Finance faces, is understandable. However, the dots have not all been joined yet to meet the standard of the “Growth Budget”. Still, there is always room for the Minister of Finance to prove Treasury forecasts wrong, with next year’s election looming.